ACM Research (ACMR): Undervalued semiconductor maverick leveraging its dual citizenship

Fabricating alpha in China from the U.S.

Hi everyone, I’m really to be writing again after a one month sabbatical. The last month has been quite volatile for the markets and me personally and well I’ve taken the time to research into some high alpha opportunities trading at attractive valuations. I hope to be more regular and give you a one week bonanza of my best ideas before not disappearing again (hopefully haha). Now let’s just dive straight into the investment idea that I have for you guys.

History of ACMR

ACM Research (ACMR) is perhaps one of the most undervalued opportunities that I can find anywhere globally. In fact, I’ll go as far as to say that ACMR maybe even puts the myriad of net nets that I’ve covered to shame. As you can tell, I’m completely gushing over this company and for good reason. So now well you might be asking, “but Dragon, what impresses you so much about this thing?”, I hear you and so let’s begin by diving deep into into an overview and the history of the company.

ACMR is a high growth wafer fabrication equipment(WFE) manufacturer deriving almost 100% of its revenue via its Chinese subsidiary ACM Shanghai (ACMS). The Chinese semiconductor market is the fastest growing semiconductor market in the world and ACMR is very well positioned to capture a decent chunk of it. It specializes in wafer cleaning, which forms an essential part of the semiconductor fabrication process; wafer cleaning is paramount to ensuring high yields and thus a very high barrier to entry segment. The company is thus poised to gain massively from China’s dynamic and rapid drive to attain self sufficiency in semiconductors, which are now paramount to both national security and progress. The world right now is defined by the competition between the U.S. and China— the battle between the overextended incumbent Empire and its most worthy competitor striving to knock it off its perch. Within the realms of this competition, there’s probably no sector of greater importance than semiconductor— the foundation stone of mankind’s latent potential and advancement, all of mankind’s current and future technological advancements necessitate the use of semiconductors and with how the American Empire has weaponised the technology, its of unprecedented importance for the Chinese State to attain self sufficiency at the minimum and global leadership in the ideal scenario to be able to cement itself as the Greatest Power of the 21st Century. The race for AI dominance and AI wünderwaffe is funnily enough between Chinese living in the People’s Republic of China and Chinese living in the Republic of China and the U.S. as this article will demonstrate now.

So now that I have the perfect segue, let’s talk about David Wang, the founder and CEO of ACMR, whose life is a weird mish mash between the U.S. and China. Wang was born in China to ethnic Chinese parents and did his bachelors from the very prestigious Tsinghua University in Beijing, he then moved to the U.S. and worked for many years at Lam Research, one of the leaders in the WFE space globally. After his stint at Lam Research, he founded ACM Research in Silicon Valley in 1998 marking his own foray into the WFE space. ACMR struggled for many years to break into the supply chains of established industry incumbents TSMC and Intel, who already had their existing network of suppliers and didn’t want to give a random company a shot. Wang thus realized that he had to do something unique and outside the box to have a chance at making ACMR a global player, he looked towards his country of birth and realized the large potential that its semiconductor market could have in the future and so established ACM Research Shanghai (ACMS), a joint venture between ACMR and the Shanghai Government’s venture capital firm, which ACMR would come to fully own in the near future. Wang’s decision to establish a subsidiary in China proved to be a stroke of genius with it now contributing 99% of ACMR’s total revenue. Wang is a U.S. citizen with a Chinese green card effectively playing both sides in this intense competitive rivalry and this is as big a red flag as it's a green flag and so warrants its own section which I’ll get to in due course.

WFE market in China

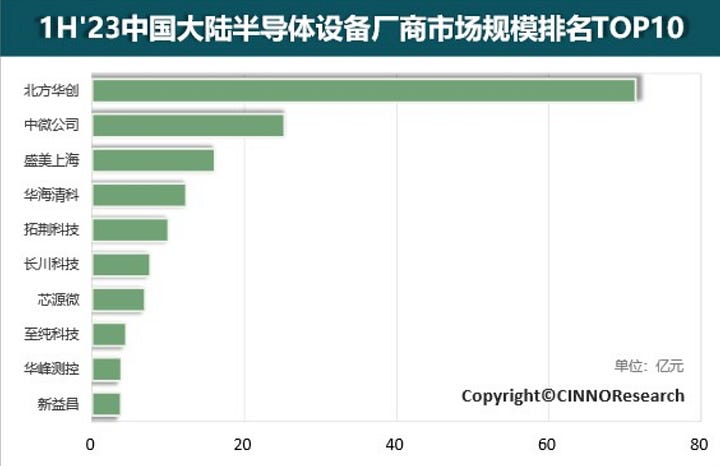

The global WFE market is very oligopolistic and specialized with a handful of companies dominating various equipments at almost every step of the process. The Chinese market however is very different with various players competing within the same niche. Along with the national champions NAURA and AMEC, there are various other smaller players like Hwatsing, KINGSEMI, CETC etc along with unlisted players like SiCarrier (spun off from Huawei), SMEE among others. This dynamic however is looking like it’s going to change rapidly with the State encouraging M&A to consolidate the sector and allow for faster localization and innovation rather than mass competition which can be quite distracting in a sector like semiconductor WFE that involves cutting edge innovation.

Cleaning (the sector that ACMR operates in) is an approximately $2 billion market in China. Japan’s Screen is the global market leader with Lam Research, Tokyo Electron, and ACMR trailing just behind. ACMR is the domestic leader in the sector with 61% market share among local players. ACMR begun its China by starting with lower grade cleaning tools and has gradually expanded to cover just about every step of the process. The company is now a supplier for almost every major domestic Chinese fabrication. At YMTC, China’s largest memory producer, ACMR is their largest supplier with 40% share vs 35% for Screen. An important thing to keep in mind is that a large part of the fabrication capacity was established before these sanctions, export controls, and tariffs, presently domestic suppliers will have to account for more and more of the new supply coming online because of these issues as well as domestic Chinese government policies. Interestingly, at YMTC, ACMR’s machines were actually more expensive than Screen’s machines but YMTC still chose to go with ACMR because of lower total cost of ownership via increased output and throughput, so much for Chinese companies only being cheap because of low prices.

NAURA and AMEC are planning to expand their product lines via both organic and inorganic expansion . I believe that ACMR’s high existing market share, goodwill with customers, and technological knowhow will allow it to maintain and even increase its market share in the next five years. The drive for M&A is quite positive for ACMR since it allows them enough liquidity to invest some of their stake in ACMS realizing instant value for shareholders. NAURA recently acquired a 7-8% stake in KINGSEMI and Hwatsing acquired Xinyu semiconductor entirely. ACMR has expressed interest in selling 20-25% of their stake in ACMS and the current market environment and actions will accentuate this process if management chooses to execute. Let’s now take a deeper look into ACMR’s product line:-

Space Alienated Phase Shift (SAPS): employs alternate phases of mega sonic waves uniformly across the entire wafer surface to improve particle removal efficiency.

Timely Energized Bubble Oscillation(TEBO): uses the precise control of bubble cavitation to enable damage-free cleaning of 2D and 3D patterned wafers at advanced process nodes.

Tahoe: uses sulphuric peroxide mix (SPM) cleaning technology required for advanced process nodes. Tahoe integrates both wet bench and single wafer processing to reduce chemical usage by 80%, which lowers total cost of ownership and operation.

They are doing various other things that I unfortunately don’t have the scientific acumen to decipher but the overarching point is that they’re doing quite well and continuing to innovate. They personally project that they will command 55-60% of the Chinese semiconductor cleaning market, which obviously is quite bullish. Taking a small detour for a second, I think that NAURA, AMEC, Hwatsing etc will be greater winners than ACMR by virtue of being fully domestic companies rather than ACMR’s weird dual citizenship model which might put it into some crosshairs but the discount is intriguing enough to outweigh the risks. I’m actually so bullish on this sector that I’m considering buying into NAURA (despite its more expensive valuation). In any which case, all of this is a topic for another day so enjoy these sexy graphs posted by TP Huang on X outlining ACMR’s stupendous growth along with the whole sector of course.

ACMR as an investment

There is a great opportunity ahead for the Chinese semiconductor in general and ACMR in particular. According to a report by GS in 2023, Chinese semiconductor demand comprises about 35% of total semiconductor demand but Chinese domestic production is only about 7-8% of total domestic demand. That figure has probably risen quite a bit by now (early 2025) but there’s still significant room for growth. China is perhaps the only country in the world that is looking to build an entirely domestic semiconductor supply chain and any move that the U.S. makes to strangle Chinese semiconductor advancement and development will only exacerbate the development of the sector even further. Thus I think that I’ve made it evidently clear that the sector is primed for inevitable success and growth, now that this is out of the way, what do you think ACMR’s valuation should be? 5-10x revenue? well it does trade at near those multiples… but in China on the A share STAR market. ACMS (83% owned by ACMR) trades at about 7x sales and 35x PE while its parent headquarters in Fremont, California and listed on the NASDAQ trades at near 1x 2025E revenue and a $1.5 billion market cap. The Shanghai listed subsidiary has a market cap of $5.9 billion market cap and the American hold co trades at about a 75-80% discount to its own subsidiary. Such a massive discount in the context of a fast growing industry like semiconductors is outrageous, if both were to trade at parity then the potential upside is near 300%.

Sanction risks and how it may play into investors’ hands among other things

Now let’s discuss the reason for the large discount between the holdco and the subsidiary— the risk of geopolitical conflict between the U.S. and China boiling over to asset seizures and sanctions. While these risks do exist, I don’t think they will necessarily be turn out to be a negative for the company and its shareholders, allow me to explain why. Firstly there’s no reason for the Chinese government to seize ACMS’s assets as for all practical purposes ACMS is a Chinese company; ACMS is incorporated in Shanghai, only serves Chinese clients, only uses its proprietary technology which does not depend on any U.S. imports and is developed in China, and supplies to all of China’s fabrication national champions. ACMS’s management is ethnically Chinese and was born in mainland China with Wang Jian, the CEO and brother of David Wang probably being a Chinese citizen( he hasn’t spent any time in the US and was educated in China). On the topic of citizenship, David Wang’s American citizenship allows him a lot of leverage; there has never been any use of a domestic American domiciled company with an American CEO being sanctioned by the US government, the most that the U.S. government can demand is for ACMR to sell their Chinese operations in case tensions boil over and the US decides to completely decouple itself from China with even more belligerence. Under such a scenario, investors in ACMR would earn multifold returns as the value of the Chinese subsidiary would be entirely unlocked all at once; even under the worst scenario where ACMR is compelled to accept a low ball offer from a prospective buyer, there’s still the prospect for at least 100% upside. ACMS trades at about a $6 billion market cap and even if ACMR were to receive $3 billion for it then that’s a 100% return from the current market cap of $3 billion. It doesn’t have to end this way however and this is the worst case scenario possible.

There’s many other ways for management to bridge the valuation gap, the management could pursue a Hong Kong dual listing with freely convertible U.S. shares, this will attract Hong Kong, mainland and other Asian based investors who don’t have PATRIOT ACT investment mandates. Another way for ACMR management to unlock value is for ACMR to liquidate a part of their ACMS holdings and repatriate that money to either pay out to investors in the form of a special dividend, conduct buybacks, or spend it building their planned facility in Oregon. Any of these moves will attract the attention of the market and lead to an immediate re-rating boosting investors’ alpha.

Now, coming to the main anti-thesis— the management’s lack of willingness to do something, the management has been sitting twiddling their thumbs for far too long. There has been simply no effort put in by the management to do anything; I mean, think about it, such opportunities will such huge discounts should not exist specifically in a hype sector like semiconductors where liquidity isn’t an issue. An HK listing should have come a long time ago and so should’ve management’s other efforts. This is specifically weird because the management has actual physical tangible interest put into the holding company (ACMR and not ACMS), David Wang’s entire shareholding is in ACMR and not in ACMS because of ACMS’s low liquidity; a value unlock in ACMR works as much in the interest of management as it does for shareholders— our interests align here. I’m hopeful of the value unlock because well the management will also benefit from it, their lethargy however can be very frustrating. Thankfully, after all this time, management finally seems to be showing interest in liquidating some of their ACMS stake to pay for their Oregon facility in the US. I personally don’t care for the Oregon facility but any stake sale will provide a re-rating and a better exit multiple for shareholders allowing us to cash out on some high alpha.

A lot depends on management execution here and if it all works out then there’s significant gains to be had here and this is one of the most undervalued opportunities I can find in the global markets right now. For international investors, ACMR provides the cheapest and most accessible way to invest in the rapidly growing domestic semiconductor industry in China.

Closing Remarks

I’m really glad to be back, there’s going to be 3-4 more stock ideas releasing in the next two weeks or so. I had planned to cover this stock when I initially bought it at around 18 USD but it quickly ballooned to 25 USD before I finished the write up and I cashed out my gains because well a 60% increase in two weeks isn’t very healthy despite the prevailing discount. I think 20-22 USD is a very attractive entry price for this stock and I’ll be looking to add again at that price. Thank you for reading and I hope you have a great week ahead.