Chinese Restaurant Stock Analysis Series Part 2: Haidilao (6862.HK)

From Broth to Billions: Haidilao's Simmering Investment Potential

Welcome to the second part of my Chinese restaurant stock analysis. In this post, I shall be covering Haidilao International Holdings, the largest Chinese hotpot chain. Haidilao like most hotpot chains traces its origins to Chengdu, which is one of my favorite cities that I’ve been to, in the Sichuan Province of China. Sichuanese people love two things even more than they love themselves: hot pot and mahjong. Hot pot is traditionally a Sichuanese dish but is now popularly eaten all over China with there probably being more than a thousand hot pot restaurants in Chengdu alone so what really differentiates Haidilao from all of its competitors that drove it to become the largest hotpot chain in China? I’ll cover all that and more in this analysis so stay keep reading.

History of Haidilao

Haidilao was founded by Zhang Yong, his girlfriend at the time Shu Ping, and two of their friends in Chengdu in 1994. Haidilao’s first restaurant in Chengdu only had four tables in total and the co-founders invested a joint sum of 10,000 yuan into the business with most it being invested by Shu and Yong undertaking the position of General Manager of the restaurant. Zhang Yong comes from very humble origins; he dropped out of high school to work at a tractor factory and managed to begin his venture as a restauranteur by convincing his co-founders including his girlfriend that he would compensate them the entire investment amount if the venture failed as he didn’t have any money of his own to start the business. We’ve always been sold the “American Dream” by the media but this story could easily be the Chinese version of that cliché. Zhang even honestly admitted later that he didn’t know how to make a traditional Sichuanese broth when he started the restaurant, which I wholeheartedly respect. What Zhang lacked in culinary skills he more than made up for it when it came to his entrepreneurial skills by pioneering a unique model for operating restaurants that would gradually be adopted all over China but to understand how he did it, we first have to take a brief detour into understanding how the restaurant chain’s dish enabled this model to take shape.

Hotpot is a simple Chinese dish which consists of a single or multiple soup broths and either meat or vegetables or both being simmered and cooked in the broth. Now think about this holistically as compared to a Western style fast food restaurant and how the costs to operate those are way higher. Firstly, the highlight of the dish i.e. the soup broth can be made at large scale at very low costs because a hotpot soup broth hardly requires one or two specific ingredients and easily be reheated without losing its flavor. Contrast this with something like a burrito chain along the lines of Chipotle where you need burritos, cabbage, meat, beans, guacamole, sour cream etc and someone to assemble and cook the burrito in order to serve the customer. Since the cooking in a hotpot restaurant is done by the customer, the restaurant doesn't really need to hire many chefs who are usually the most expensive employees to hire in a restaurant. Secondly, the average order value for hotpot dining is obviously going to be way higher because customers need to pay for both the soup broth as well as individual food items. As compared to a burger or burrito wherein a single burrito or burger is likely to fill a customer’s appetite while in the case of a hotpot you need to order multiple individual items as well as the soup broth to be full. The average order value at a McDonald’s in China is around 50 yuan while the average order size at a Haidilao is around 100 yuan. While cost of operating both stores vary, an average Haidilao restaurant is so cost optimized that they also pay about 1% of their revenue in rent. How they manage to be this optimized I’ll cover in the next section.

Zhang Yong’s genius operating structure

Haidilao’s competitive advantage when it comes to managing their costs and keeping them low is very similar to how BYD or other electronics companies manage their costs i.e. by owning the entire supply chain and backwards integrating. The Zhang Yong universe of companies is demonstrated in the chart below and I’ll be going over them one by one. These companies are all either listed on the Hong Kong Stock Exchange or the Mainland exchanges.

Shuhai: Shuhai is the meat and produce supplier of Haidilao. Haidilao procures all of their meat and produce from Shuhai only.

Weihai: Weihai is a human resource management company. They’re responsible for employee recruitment and training. This is because Haidilao’s employee structure is very dynamic with high turnover rates as well as promotion rates hence all of this is outsourced to Weihai

Yihai: Yihai supplies the sauces and other such condiments to Haidilao. They produce the sauces in bulk at a very cheap price.

Shu Yun Oriental: The store management and renovation is managed by Shu Yun Oriental.

This backwards integrated structure allows Haidilao to manage its costs very effectively with rent only accounting for a figure equal to 1% of its revenue. This structure allows Haidilao to streamline its costs allowing it to pass on the cost savings to its employees. Haidilao’s employees are essential to ensuring that it can grow and maintain its brand I’ll explain why in the next section.

Haidilao’s employee compensation and work culture

Haidilao’s employees are paramount to the whole company's operation and why Haidilao has a cult like following in China. Because of their optimized and backwards integrated cost structure, Haidilao has the ability to compensate its employees to an extent far and beyond the norm in the restaurant industry not only in China but also globally. Haidilao’s employee compensation is demonstrated below.

The most basic pay for a server at a Haidilao restaurant is between 5000-8000 RMB or 700-1100 USD a month which is way above the industry convention. There’s no real qualification required to become a Haidilao server even people with primary school qualification can become a server.

What truly motivates the employees to go above and beyond in their service towards customers is the prospect of promotions. The highest position in the employee structure is the captain or the store manager and its the compensation provided at this level that motivates employees and stimulates them to perform better. The salary listed here for a captain is 30,000 RMB a month or around 4141 USD but the average captain earns around 107,000 RMB a month or 15,000 USD a month. This is so because of the unique commission and mentorship program that they have.

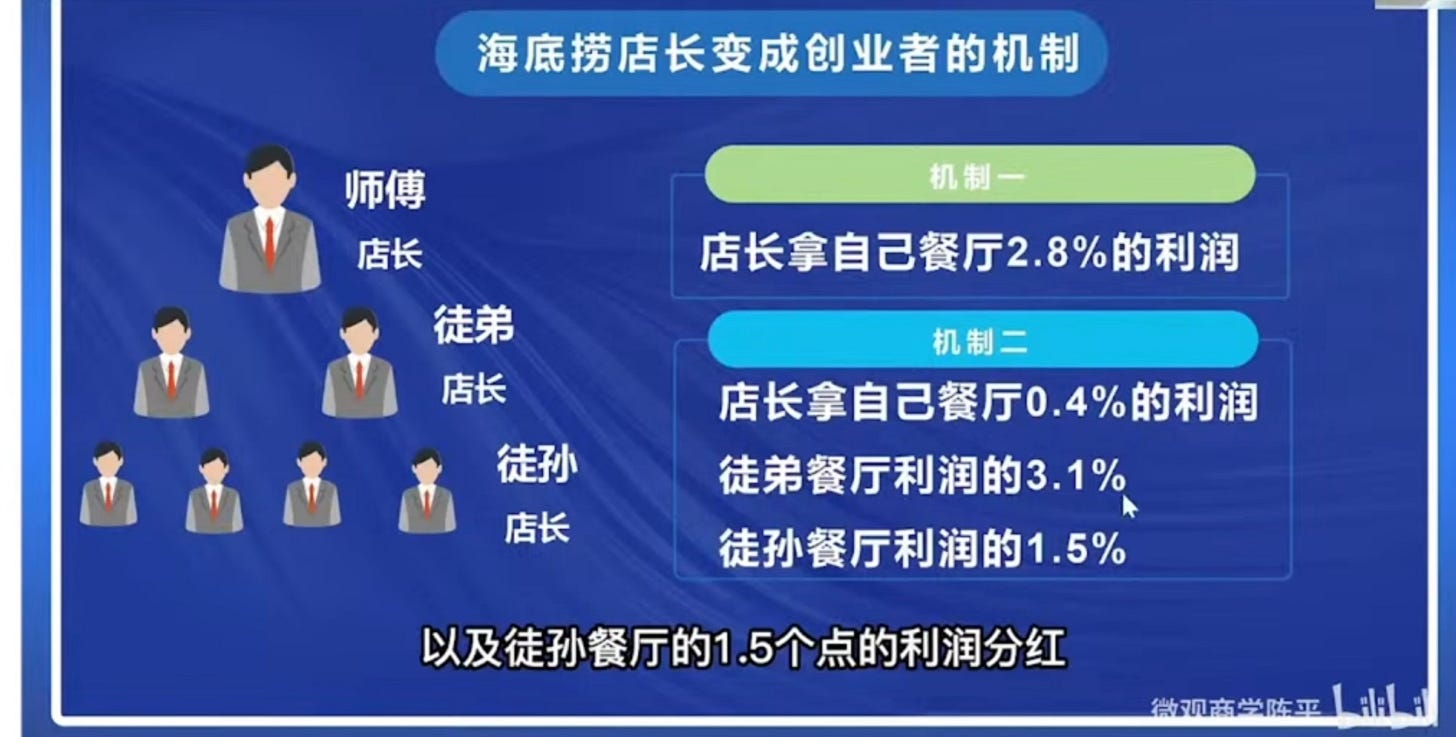

A captain has the option of choosing between two compensation structures:-

He/she can choose the first structure wherein they are entitled to 2.8% of the net profit of the restaurant that they manage. 90% of the captains don’t take this option and choose the other option

He/she can choose the second structure wherein they have the option of training and grooming a younger rising manager. If this manager gets promoted to captain at a new outlet then their mentor gets a commission of 3.1% of the new outlet’s profit . The cycle then continues if this new manager trains a younger manager who then gets promoted to manager then the mentor of the first manager shall be entitled to a commission of 1.5% of the new outlet and so on.

This creates an organization culture of training and grooming which is also financially rewarded. There is no discrimination on the basis of qualification as well with even primary school educated employees having the prospect of rising through the ranks up to manager. The company has a surprising low employee turnover rate of only 10% demonstrating that despite the restaurant industry traditionally having exorbitantly high turnover rates.

Most of the company’s popular innovative service initiatives such as offering plastic bags to protect customers' phones and hair ties for long-haired patrons, which have been implemented across the chain's locations were actually coined by employees instead of the company’s top management. Its only because of the highly financially motivated and satisfied employees that Haidilao has been able to build its brand based on service which I’ll discuss now.

Haidilao’s brand and why customers love them

Haidilao’s service-centric approach is rooted in Zhang Yong’s vision who believed that in a competitive food industry, where product differentiation is minimal, service could be the key differentiator. He emphasized that customer satisfaction should be the top priority, and this philosophy became the cornerstone of Haidilao’s brand identity. Haidilao’s service goes beyond the conventional. The company has redefined what it means to provide excellent service in the restaurant industry. Some of their unique customer service initiatives include:-

Pre-Meal Amenities: While waiting for a table, customers are offered complimentary snacks, drinks, and even manicures, shoe shining, or board games. This transforms the often tedious waiting time into a pleasant experience and gives the customer an excellent first impression.

Personalized Service: Haidilao staff are trained to anticipate customer needs. For example, they may provide hair ties, phone covers, or glasses cleaning cloths without being asked.

Entertainment: Noodle dancers perform at tables, stretching and twirling dough into noodles, adding an element of entertainment to the dining experience.

Post-Meal Care: Customers are often given small gifts or desserts as they leave, leaving a lasting positive impression.

I visited Chengdu recently and the service that I got at their restaurant truly made me feel like a king. The server who was an old lady was so nice and polite that I truly felt like giving her a 500 RMB tip but since tipping isn’t really prevalent in China, I had to stop myself to prevent her from feeling awkward or embarrassed. Some of the schenanigans that you witness when eating at a Haidilao are shown below.

The Haidilao brand is so crazy in China that I downloaded the Haidilao app and tried to book a reservation everyday that I was in China and the minimum waiting time was at least 45 minutes for an individual non sharing table.

Haidilao has also adopted smart restaurant automation with all orders being taken through an iPad and robot servers almost everywhere in their restaurant. These innovations not only allow them to reduce costs but also use customer analytics to figure out consumer’s spending habits and preferences to serve them better.

The Haidilao brand is so popular in China that they even sell Haidilao hot pot branded lipsticks on Taobao and T Mall, if that doesn't scream moat then I don’t know what does honestly.

COVID and difficult macro

The COVID net zero lockdowns in China hit Haidilao’s business really hard. Hotpot is a communal dining experience that’s best enjoyed in the company of close friends and family and COVID completely restricted that. The company did try to innovate by offering takeaway delivery hotpot bases but it didn’t really materialize.

Another mistake was the management’s misjudgment of the severity of the pandemic and the lockdowns. Zhang Yong had been running his business when the SARS virus broke out in China which was contained in a very short time span so he anticipated the same for COVID and undertook a rapid expansion sensing low rentals and pent up demand after the shutdown had ended. Unfortunately, the COVID lockdowns continued on and off for almost two long years in China and the expansion plans were completely foiled. Haidilao closed down 260 of the 300 restaurants that it had newly opened in a move that I for one completely respect; it takes great courage to realize, own up to, and act to remedy one’s mistakes.

For the last two years, there has been a considerable slowdown in consumer spending as consumers tighten their wallets during this deleveraging cycle of the Chinese economy as such Haidilao hasn’t really gotten back to its pre COVID levels of growth but has held up surprisingly well, growing revenues by 13.8% in H1 24 and 33.6% in FY23. Profit did dip slightly by 4.4% in H124 due to the government revoking their preferential VAT policy for restaurants who had been unfairly hurt by the COVID lockdowns and forex losses but core operating profits grew up by 13%.

Growth and valuation prospects

The company has a clear moat which has to be accounted for that differentiates it from other Chinese restaurant players. In fact it reminds me a lot of Charlie Munger’s favorite company -Costco- in the way that it compensates its employees better than the industrial average which motivates them and stimulates them to serve customers better. The company had to undergo tough operating conditions for 4 years but with macroeconomic conditions improving the situation looks brighter than before.

To fuel further expansion, the company is experimenting with a franchise model but it remains to be seen how well they can maintain their standards. Judging by their previous operational excellence, I presume that they’ll be able to make it work. The scope for expansion lies in expanding to Tier 3 cities and more rural areas where the allure and exoticness of the brand especially on social media will drive high amounts of traffic.

The company still has a table turnover rate of 3.9 which while above the industry average of 2 is still below their pre COVID level of 5. If the company can grow to this level then there’s a decent amount of extra growth to be had.

The company is almost 60% owned by the founder and his wife who’ve become Singaporean citizens now and they need the company to pay out dividends for them to continue buying up Singaporean real estate so the dividend is pretty safe.

Let’s divide my growth and valuation assumptions into four categories:-

Super Bear Case: The macro environment remains bad for the next 5 years and gets even worse leading to a deceleration in profitability and basically no restaurant expansion at all. Profit growth assumed at 7% and a future PE multiple of 13x because the brand deserves a premium gives us a future market cap of 94.45 billion and an expected dividend+stock price compounded return of 12.18%.

Decently bear Case: The macro environment remains mostly the same and thus profit grows at 10% for five years and future PE multiple is around 14 times giving us a future market cap of HK$104 billion and a future dividend+ stock price compounded return of around 15.11%. The reason why I still consider this bearish is because of two key factors- firstly, I don’t believe that the current macro scenario will continue secondly, even despite the absolute terrible macro that we’ve had in terms of consumer spending over the past four years the company still grew its operating profit by 13% in H124.

Base Case: The macro environment improves considerably and the company grows stores by a very conservative 2% a year add to that an increase in consumer spending and I think 12% profit growth and 14 times earnings is a fair maybe slightly conservative assumption to have. That gives us a future market cap of HK$114 billion and an expected dividend+ stock price compounded return of 17.04%.

Bull Case: The macro environment improves by a whole lot, consumers begin spending like they did pre-COVID, the franchise model becomes a resounding success and everything is amazing. 15% expected profit growth and a 15x future PE multiple gives us a future market cap of HK$145.12 billion and an expected dividend+stock price compounded return of about 21%.

All of these factor in no dividend increases which is fairly conservative as well.

Conclusion

I’m so so so thankful to each and everyone one of you who subscribed to me in the one week that I’ve been posting for. The fact that so many of y’all are deriving value from my posts truly means the entire world to me and makes me truly genuinely happy from within.

Stay tuned for the third part of the series releasing soon on DPC Dash, the Domino’s Pizza operator in China.

I hope you have an amazing weekend ahead. Thank you for reading.

We are not fond of the structure of Haidilao ’

s business as it doesn ’ t own the trademark to its namesake

brand. Instead, the firm licenses the Haidilao brand from a company privately held by founder Zhang

Yong. We think this model exposes Haidilao ’

s shareholders to additional risks and contingencies.

The hot pot chain operates in a highly competitive industry marked by nonexistent switching costs,

minimal barriers to entry, and quickly evolving consumer preferences. Even with the firm ’

s leadership in

the hot pot category, long-term investors will need to contend with the cyclicality of a no-moat business

as well as potential corporate governance issues.

Great stuff! But I am failing to understand the dividend thesis here. They dont have a very successful history of dividend paying. Its only in 2024 that they have paid out reasonable dividend. Would it be fair to extrapolate it to future. Secondly I couldnt tally per share dividend with the impact in financial cash flow. The maths doesn't work.