My views and perspectives on current and future global macro in a deeply divided and unstable financial world: The U.S. and the New Cold War

All the chickens will come home to roost

Welcome to the second part of my views and perspectives on current and future global macro in a deeply divided and unstable financial world. In the first part, I covered the macroeconomic impossible trinity that the Bank of Japan is dealing with along with the large bubble forming in passive investing particularly in the large Western indexes like the S&P 500 and DAX. If you’re interested in learning more about these topics— they will help you make more sense of this article— then check out Part 1 of the series. Now, in this part, I’ll cover the macroeconomic conditions, tailwinds, and headwinds that the U.S. will experience both in the present and in the future. With all that out of the way, I’ll begin by sharing my thoughts on the U.S. in the next section.

The United States of America and its role in the post World War II world, Bretton Woods, the Global Plan, how it went kaput, and how the US adapted

America, always is a fun and curious case to explore is it “the land of the free”, “the land of opportunity”, and “the leader of the free world” or is it the “land of guns, bald eagles, hippies debt,, and exceptionalism” well I’ll leave that up to your interpretation. The U.S. empire has been the dominant hyper power of our times even going back to the time when probably your grandparents were born. In the last 100 years we’ve lived in America’s century and America’s world where either we complied or like some bold men who tried— bombed. Unfortunately—for the people who’ve benefitted from the Empire’s grasp on the entire world— times are now quickly changing. No longer is America, the one true superpower of the world who can do no wrong and remain unchallenged. For the first time in the history of the Western Empire (the British Empire and its subsequent successor, the U.S. empire), it faces immense competition from the two civilizations and people groups who it has always tried to oppress, eliminate, and force to comply— The Russian Federation and The People’s Republic of China. Now, I hear you asking, “ Dragon, why are you talking about geopolitics, I thought this was about macro”, well geopolitics and macroeconomics go together reader there’s no two ways about it. To explain the U.S.’s current position, let’s take a quick historical detour to understand American history post World War II to the present day.

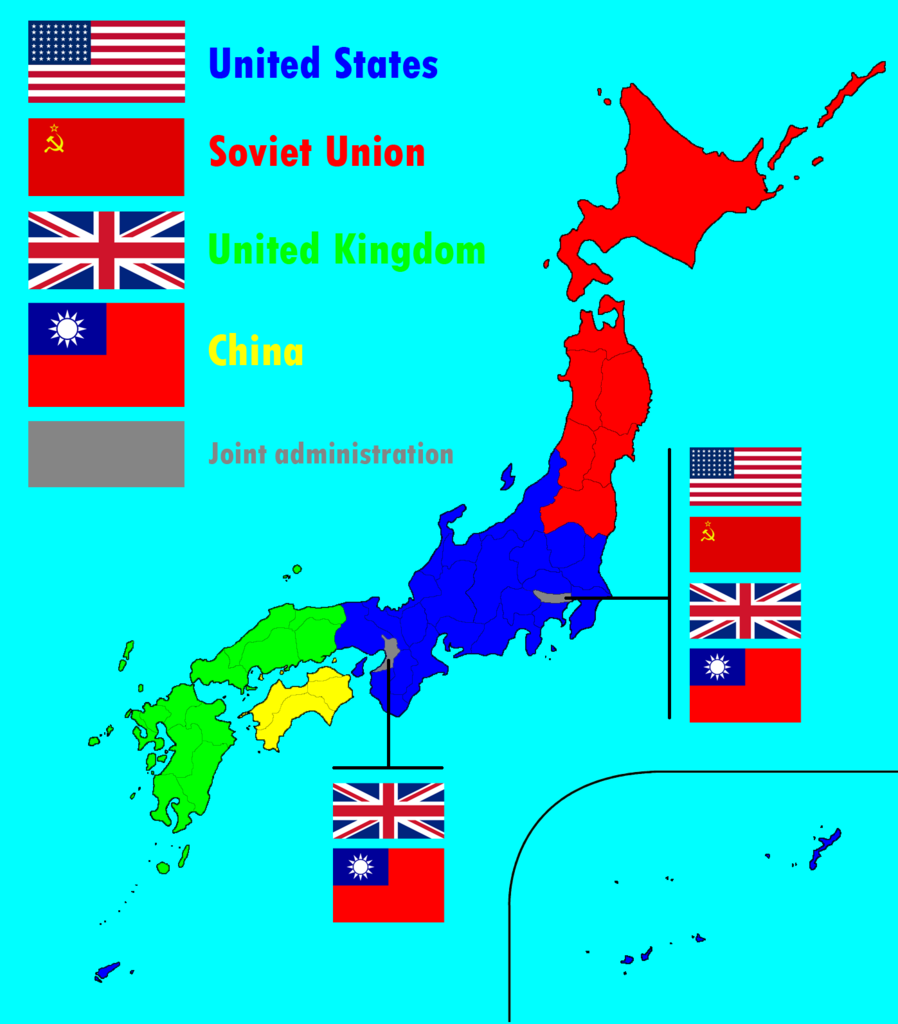

The year’s 1945, American troops are landing in Normandy while troops from the Red Army are almost nearing the German border. Within the American camp, there was a mad dash and a sense of restlessness to somehow take over Berlin— not because they wanted to defeat the Germans, or basically any other noble cause that you can think of, the Germans were for all practical purposes, completely done for, and this was not the work of the French, Brits, and Americans (who frankly sat around doing jack diddly squat) but instead all the work of the Red Army. Russia lost 27 million men fighting World War II— America’s contribution to World War II was not the defeat of Nazism in Europe or imperialism in Asia but rather stealing the valor and effort of others to present it as their own through their overarching control over media. Well, you might be thinking, “ but Dragon, what about the nukes at Hiroshima and Nagasaki, the Americans defeated Japan didn’t they?’’. Well, you innocent soul, look up how much mainland Japanese territory that the Soviets physically took over before the U.S. started firing nukes, I’ll attach the proposed peace plan for bifurcation of Japan for your reference here.

So anyways, Japan gets nuked and surrenders, both the Soviets and the Americans Berlin and divide Germany among themselves. The Marshall plan is implemented in Europe to rebuild and rejuvenate it all with U.S. monetary backing. Ask yourselves for a second, what was the real goal of the Marshall plan, was it just born out of American sympathy and good faith towards their fraternal brothers in Western Europe— if you believe this then well I have a bridge to sell you, the U.S. is after all a country born out of displacement and genocide of native ethnic groups, do you seriously think the U.S. political and capitalist elite who throughout the course of their history went from pure barbarism to pure decadence would ever operate out of sympathy and good faith. The answer to that rhetorical question is a resounding no, the U.S. implemented the Marshall Plan in Europe and the economic restoration plan of Japan because they wanted to transition from being a plain vanilla country to being an empire, imperialism never really ended— the U.S. is an imperialistic power that operates with the facade of democratic elections. After the implementation of the aforementioned plans, Western Europe and Japan swore unconditional allegiance to the U.S. and became the vassal states of the Great American Empire.

The new global monetary order was shaped by the Bretton Woods agreement under which the U.S. Dollar—pegged to the price of gold—would become the sole global reserve currency for trade and the price of all commodities would be denominated in the U.S. Dollar. The U.S. was the sole hegemon of the world and it would thus endure on a series of campaigns to ensure that it would remain so. Yanis Varoufakis labels this the American Global Plan and since I like the terminology I’ll use it as well.

The Global Plan's path was not all smooth sailing though. A succession of misfortunes characterized its development, with Chairman Mao's victory delivering the initial blow. In a remarkable way, it responded inventively to challenges, frequently as a result of unforeseen outcomes. We have already observed how the Korean War was utilized to strengthen the Global Plan's eastern flank. Therefore, when the United States entered the Vietnam War, a comparable wave of 'creative destruction' was expected. Although it is a severe understatement to claim that its pursuit went according to the original plan, the Vietnam War's positive aspect is evident to anyone who has ever traveled to Southeast Asia. Korea, Thailand, Malaysia, and Singapore experienced rapid growth in a manner that confounded the skepticism of those who believed that developing nations would struggle to embark on the path to capital accumulation essential for lifting them out of extreme poverty. In doing so, they offered Japan valuable trade and investment prospects, which alleviated the strain on the US authorities who, prior to the mid-1960s, had singularly borne the responsibility of generating sufficient demand for Japanese factories in Europe and the US itself.

The issue with unintended outcomes is that they are not consistently beneficial. Ho Chi Minh's unwavering determination to win the war, and Lyndon Johnson's almost obsessive dedication to achieving victory, played crucial roles not only in fostering a new capitalist region in the Far East but also in derailing the Global Plan. The rising financial costs of that war were a significant factor in its eventual collapse. Setting aside the dreadful human toll, the conflict cost the US government approximately $113 billion and the US economy an additional $220 billion. Real US corporate profits shrank by 17%, while between 1965-1970, war-induced price increases caused the real average income of American blue-collar workers to decrease by about 2%. [2] The war was inflicting damage not only ethically and politically, as an entire generation of American youth was shaped by the fear and hatred of Vietnam, but also in terms of a tangible decline in working-class income which exacerbated social tensions. It can be argued that President Johnson's Great Society social initiatives were largely intended to alleviate these strains. As the combined expenses of the Vietnam War and the Great Society began to escalate, the government was compelled to create mountains of US government debt. By the close of the 1960s, numerous governments started to worry that their positions, which were interconnected with the dollar within the context of the Bretton Woods system, were being compromised.

By early 1971, dollar liabilities surpassed $70 billion while the US government held only $12 billion in gold to back them. The increasing volume of dollars was saturating global markets, generating inflationary pressures in countries such as France and Britain. European governments had to boost the amount of their own currencies to maintain their exchange rate with the dollar stable, as mandated by the Bretton Woods system. This forms the foundation for the European accusation against the United States that, by engaging in the Vietnam War, it was transferring inflation to the rest of the world. Beyond just inflation concerns, the Europeans and the Japanese worried that the accumulation of dollars, against the backdrop of a steady US gold reserve, could trigger a run on the dollar which might then compel the United States to abandon its longstanding commitment to exchanging one ounce of gold for $35, in which case their stored dollars would depreciate, eroding their national 'savings. ' The flaw in the Global Plan was closely linked to what Valery Giscard d'Estaing, President de Gaulle's finance minister at the time, termed the dollar's exorbitant privilege: The United States' extraordinary ability to print money freely without any global institutional limitations. De Gaulle and other European allies (along with various governments of oil-producing nations whose oil exports were priced in dollars) accused the United States of establishing its imperial reach on borrowed finances that undermined the prospects of their nations. What they neglect to mention is that the entire premise of the Global Plan was built around a surplus-generating United States.

When America became a deficit nation, the Global Plan inevitably spiraled into a destructive tailspin. On 29th November 1967, the British government devalued the pound sterling by 14%, far exceeding the Bretton Woods 1% limit, igniting a crisis and forcing the United States government to utilize up to 20% of its total gold reserves to defend the $35 per ounce gold peg. On 16th March 1968, representatives of the G7's Central Banks convened to negotiate a compromise. They reached a peculiar agreement that, on one hand, maintained the official peg of $35 an ounce while, on the other, allowed speculators to trade gold at market prices. When Richard Nixon won the US Presidency in 1970, he appointed Paul Volcker as Undersecretary of the Treasury for International Monetary Affairs. His responsibility was to report to the National Security Council, led by Henry Kissinger, who would become a highly influential Secretary of State in 1973. In May of 1971, the taskforce headed by Volcker at the Treasury presented Kissinger with a contingency plan that considered the idea of 'suspension of gold convertibility. ' It is now evident that, on both sides of the Atlantic, policymakers were competing for position, anticipating a significant transformation in the Global Plan.

In August of 1971, the French government issued a very public declaration of its irritation with the United States' policies: President George Pompidou commanded a destroyer to travel to New Jersey to exchange US dollars for gold stored at Fort Knox, as was his entitlement under Bretton Woods! A few days afterward, the British government led by Edward Heath made a similar appeal, albeit without employing the Royal Navy, requesting gold equivalent to $3 billion held by the Bank of England. President Nixon was extremely enraged. Four days later, on 15th August 1971, he declared the practical conclusion of Bretton Woods: the dollar would no longer be exchangeable for gold. Consequently, the Global Plan disintegrated.

The United States had neither wanted nor resigned itself readily to the collapse of the Global Plan. However, once America lost its surplus position, US policy makers were quick to read the writing on the wall. They then moved on very rapidly.

Perhaps the best narrative on the violent abandonment of the Global Plan comes from the architect of its replacement. In 1978, Paul Volcker, the man who was among the first to recommend that Bretton Woods should be discarded, addressed an audience of students and staff at Warwick University. Not long after that speech, President Carter appointed him chairman of the Fed. “It is tempting to look at the market as an impartial arbiter... But balancing the requirements of a stable international system against the desirability of retaining freedom of action for national policy, a number of countries, including the US, opted for the latter”, these words echoed across the chambers of European policymakers almost akin to voices ringing inside the head of a schizophrenic patient also suffering from PTSD. To drive his point further across, he also added—“controlled disintegration in the world economy is a legitimate objective for the 1980s”. I think I've invoked your curiosity enough and left you wondering, “What was Volcker’s vision for controlled disintegration?’’. Stay tuned and read the next section.

The weaponization of the trade deficit: The Great American Vacuum Cleaner

Nixon sent his Secretary of the Treasury, John Connolly to Europe with a . Connally’s description of what he communicated to the Europeans was gentle and sociable: “We informed them, that we were here as a nation that had contributed much of our resources and our material resources and otherwise to the World to the extent where, frankly, we were now incurring a deficit and have been for twenty years and it had depleted our reserves and drained our resources to the extent where we could no longer continue, and frankly we were in trouble and we were approaching our friends to seek help just as they have frequently in the past come to us to request assistance when they were facing difficulties. That is essentially what we conveyed to them.”.

Let’s break down this Texan’s words: he claims that America had depleted its reserves and contributed its resources to the World and its allies when in fact there was not a single rifle, tank, ship, or airplane that it gave to its allies during World War II which it didn’t treat as a commercial transaction/loan and didn’t demand payment for. Thus rendering its ally, Great Britain, completely bankrupt in 1945 after the end of the War. Anyone getting vibes of modern day Ukraine?. This is what the Americans and Brits call a special relationship much akin to what the Greek and Brussels relationship looks like presently. Nevertheless, the essence of Connolly’s words still echo in Japanese and European ears. “Our currency, your issue, deal with it”

What Connally implied was that, since the dollar was the reserve currency, meaning the only genuinely global medium of exchange, the end of Bretton Woods was not America’s concern. The Global Plan was, of course, crafted and executed to serve the interests of the United States. However, as the pressures on it (stemming from Vietnam and internal US tensions that necessitated an increase in domestic government expenditure) became so overwhelming that the system reached a breaking point, the largest loser would not be the United States itself but Europe and Japan; the two economic areas that had benefited the most from the Global Plan. It was not a message either the Europeans or Japan wished to hear. Lacking an alternative to the dollar, they understood that their economies would encounter a significant setback as soon as the dollar began to decline. Not only would their dollar assets diminish in value, but, furthermore, their exports would become more expensive. The only alternative would be for them to devalue their currencies as well, but that would subsequently lead to their energy expenses skyrocketing (given that oil was priced in dollars). In summary, Japan and the Europeans found themselves between a rock and a hard place. Toward the end of 1971, in December, Presidents Nixon and Pompidou convened in the Azores. Pompidou, acknowledged his previous actions and promptly bended the knee and apologized, begged Nixon to restore the Bretton Woods system, based on new fixed exchange rates that would represent the new ‘realities’. Nixon remained unyielding. The Global Plan was finished.

Once the fixed exchange rates of the Bretton Woods system fell apart, all prices and rates became unhinged. Gold was the first commodity to discreetly rise from $35 to $38 per ounce, quickly moving to $42 and then to float freely into the atmosphere. By May 1973, it was trading at more than $90, and by the end of the decade, in 1979, it had soared to an astonishing $455 per ounce; a twelvefold increase in under ten years.

At the same time, within two years of Nixon’s bold move in August 1971, the dollar had lost 30% of its value in relation to the Deutschmark and 20% against the Yen and Frank. Oil producers suddenly discovered that their black gold, when measured in gold, was valued at only a fraction of what it once was. Members of the Organisation of Petroleum Exporting Countries (OPEC), were soon calling for coordinated measures (i. e. , cuts in production) to enhance the black liquid’s gold value.

When Nixon made his announcement, the price of oil was below $3 per barrel. In 1973, amid the ongoing Yom Kippur war, the price surged to between $8 and $9, subsequently stabilizing in the $12 to $15 range until 1979. In 1979, a new upward trend commenced that saw oil trading above $30 well into the 1980s. And it wasn’t only the price of oil that reached unprecedented levels. All primary commodities experienced simultaneous price increases: Bauxite (165%), silver (1065%), and tin (220%) are just a few examples. In summary, the end of the Global Plan indicated a significant rise in global production costs. Inflation skyrocketed, as did unemployment: a rare mix of stagnation with inflation that became known as stagflation.

The prevailing belief regarding the cause of the 1970s stagflation is that the OPEC nations dramatically raised the dollar price of oil against the preferences of the United States. It’s an explanation that contradicts both logic and evidence. For if the Nixon administration had genuinely opposed the oil price hikes, how can we explain that its closest allies, the Shah of Iran, President Suharto of Indonesia, and the Venezuelan government, not only supported the increases but also led the effort to make them happen? How do we account for the administration’s termination of the Tehran negotiations between the oil companies (the so-called Seven Sisters) and OPEC just before a deal was reached that would have lowered prices?

The question is therefore raised: Why did the United States not genuinely oppose the substantial increases in oil prices? The straightforward answer is that the Nixon administration, just as it did not regret the conclusion of Bretton Woods, had no interest in stopping OPEC from elevating the price of oil. For these hikes were not at odds with the administration’s own ambitions for a significant rise in global prices of energy and primary commodities.

Recalling that the new objective was to discover methods of financing the US twin deficits without reducing US government expenditure, raising taxes, or diminishing US global influence, American policymakers recognized that they had a straightforward task: To attract the rest of the world to fund its deficits. However, this required a redistribution of global surpluses in favor of the United States and at the expense of the two economic zones they had established around Germany and Japan. Two were the essential conditions of the intended reversal of global capital flows which would direct the world’s capital into Wall Street for the purpose of financing the growing US twin deficits:

—Enhanced competitiveness of US companies compared to their German and Japanese counterparts; and

— Interest rates that drew significant capital flows into the United States.

Condition A could be accomplished in one of two manners: Either by increasing productivity in the United States or by raising the relative unit costs of the competitors. The US administration opted to aim for both, just to be safe. Labor costs were tightly controlled with eagerness and, simultaneously, oil prices were ‘encouraged’ to escalate. The decline in US labor costs not only improved the competitiveness of American businesses but also served as an attraction for foreign capital that was seeking profitable opportunities. Meanwhile, as oil prices increased, every segment of the capitalist world was negatively impacted. However, Japan and Western Europe (lacking their own oil) were affected far more severely than the United States.

At the same time, the surge in oil prices resulted in enormous rents accumulating in bank accounts from Saudi Arabia to Indonesia, as well as substantial revenues for US oil companies. All these petro-dollars quickly found their way into Wall Street’s welcoming arms. The Fed’s interest rate strategy was to prove especially beneficial in this regard.

Turning to Condition B, money (or nominal) interest rates surged from 6%, where the Global Plan's final years had left them, to 6. 44% in 1973 and to 7. 83% the next year. By 1979 President Carter’s administration started to address US inflation with flair. It appointed Paul Volcker as Fed Chairman with the task of decisively tackling inflation. His initial step was to elevate average interest rates to 11%.

In the subsequent year, June of 1981 to be exact, Volcker raised interest rates to a lofty 20%, and then further up again to 21. 5%. While his harsh monetary policy did control inflation (reducing it from 13. 5% in 1981 to 3. 2% two years later), its detrimental effects on employment and capital accumulation were significant, both domestically and internationally. Nonetheless, Conditions A and B had been fulfilled even before Ronald Reagan had settled in completely at the White House. A new era consequently commenced.

The United States was now able to maintain a growing trade deficit without concern while the new Reagan administration could also fund its significantly increased defense budget and its massive tax reductions for the wealthiest Americans. The ideology of supply-side economics in the 1980s, the legendary trickle-down effect, the reckless tax reductions, the prevalence of greed as a form of virtue, etc. , were merely reflections of America’s new outrageous privilege: the ability to widen its twin deficits nearly without restraint, thanks to the capital inflows from other countries. American dominance had undergone a new transformation. In the years that ensued, the times when the United States would be supporting (either directly, through war funding, or via the use of political influence) Germany and Japan faded into a distant recollection. The United States commenced importing as if there were no future and its government spent freely without concern over rising deficits. Provided that international investors transferred billions of dollars each day to Wall Street, willingly and for reasons solely tied to their profits, the United States’ dual deficits were funded and the globe continued to turn on its axis.

The Rise of China, The War in Ukraine, and the New Cold War

The outbreak of the War in Ukraine changed everything for the American Empire. The U.S. decided to weaponize the status of its currency as the global reserve currency and seize Russian foreign exchange reserves housed onshore in the US. Now you see this goes against everything that the U.S. created monetary system stood for, the U.S., for the first time, actually acted against the interest of a capitalist class anywhere in the world. Think about it, it was the wealth of both the Russian State and Russian oligarchs that constituted the Russian assets that they ended up seizing. This singular move struck fear into the heart of capitalists globally, after all their wealth was tied up in Wall Street and the U.S. now demonstrated that it did not hesitate to seize these assets in order to send a message. To further accentuate the magnitude of this move and the adverse impacts it has had on the U.S.’s global standing, let’s take a trip down memory lane again to when Trump took the Presidential Chair for the first time.

The year’s 2016, the Trump administration has just been voted into office and one of their first moves was to tear up the Obama Administration’s Iran Nuclear Deal (read: JCPOA). German chancellor, Angela Merkel, was rightly quite pissed off about this and held a press conference denouncing Donald Trump and proclaimed that Germany would not obey U.S. sanctions on Iran and that German companies would enter Iran as envisaged under the JCPOA. The very next hour, German companies begun releasing statements that they would not comply with Angela Merkel and instead comply with U.S. sanctions against Iran. German companies went against their own chancellor because they feared being cut off from their Dollar reserves and the Dollar payment system. You have to realize that the U.S. vacuum cleaner financial system was only able to sustain itself for so long because it attracted capitalists from the world over.

A large part of global trade is taxed by the US since a large part of global bilateral trade surplus flows back to the US in the form of Treasury purchases (basically financing the U.S. trade deficit). Now, imagine this situation, put yourself first in the shoes of a Saudi, Indian, or Vietnamese oligarch— you sell your products to the US, get dollars for it and invest it in the U.S.— all your money is parked in the US. You take a look at your fellow oligarch in Russia who just got his money seized and you think to yourself, “Oh shit, I’m not a good man as well in the U.S.’s eyes, maybe they will also seize my reserves, it doesn’t hurt to diversify does it”. Then think about the position of global governments— all your foreign exchange reserves presently and under the status quo will flow to the U.S. and there’s an ever looming threat of you also becoming the next Russia if you piss the U.S. off, it doesn’t hurt to diversify does it?. This is how the U.S. systemically committed monetary hegemon suicide. There’s a mad rush among all economies in the Global Majority (the Global South is a retarded term, I will not use it) to conduct local currency trade. Local currency trade on a large scale is stupid and will not work since it doesn’t solve the problem of excess foreign exchanges which ultimately have to be deployed somewhere don’t they?. Most currencies in the world don’t have any demand whatsoever and have to rely on capital controls to preserve their value. A key example of this is India who doesn’t nearly produce anything on a significant scale for there to be global demand for its currency. However local currency trade is important for small scale trade.

So on one hand, you have global economies scampering for diversification from the U.S. Dollar. On the other hand, you have the rise of China. China has had the greatest economic boom story throughout human history; no other country has uplifted as many people out of abject poverty as China has and presently no other country can compete with China’s industrial might. China however doesn’t merely compete with the American Empire on the basis of industrial production— they beat them at that game a long time ago. China can now compete with American Big Tech that 21st Century America has prided itself on and has been the American Empire’s tool techno feudalistic expansionism. After dominating the domestic market in China, Chinese technology companies now have the ability to expand and dominate globally. This is precisely why the “technological containment” of China has been America Policy 101 even across heavily divided party lines. The “containment of China” has been the only American policy point that has enjoyed bi-partisan support. The reason for the New Cold War isn’t “Chinese imperialism or Chinese spying or them taking over the Panama Canal” or whatever other bullshit that Trump feeds you. The simple truth is that the U.S. fears that China is coming for its technological hegemony now and its financial hegemony soon.

How China can shape up the new financial order in then future is a topic that warrants a deeper discussion another day. But I hope that throughout the course of this article I’ve been able to explain with historical context, the true extent of the U.S’s economic hegemony and global exploitation through sufficient historical stories and data and how the New Cold War that it has pushed itself into with China along with its War against Russia— another great power—threatens to blow this status on its head.

Thank you for reading, this post required significant research on my part and I had to read entire books to sufficiently research this vast almost never ending topic. I hope you can excuse the delay in this post which I will try and compensate by releasing two posts for you this week. Have a great week ahead.

After reading this, I’m asking myself how can I get off ibkr an US broker. I want to be truly independent of US institutions.

Have you looked at 883 ?